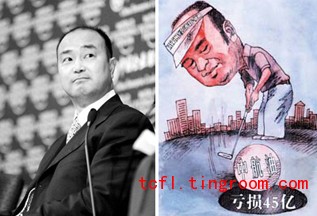

曾经的中国航油(新加坡)股份有限公司总裁陈久霖在出狱一年半后重回公众视野,身份已变成中国葛洲坝集团国际工程有限公司的副总经理。

国有航油供应商中航油于2004年濒临破产;作为主要责任人,陈久霖被新加坡法院判处四年零三个月的监禁和33.5万新元的罚款。陈成为第一个因内幕交易罪而在国外获刑的中国央企高管。

中航油自1993年成立之后持续亏损。1997年,陈久霖接手中航油,出任执行董事兼总裁,迅速领导公司摆脱困局,扭亏为盈。

然而,据普华永道作出的调查报告,2004年中航油因从事石油投机和衍生品交易导致5.5亿美元的巨额亏损,而陈久霖在这些事件中扮演了关键角色。

2009年1月20日刑满出狱后,陈久霖透露自己希望再度从事石油行业的工作,并连续发表了三篇文章,为提高我国能源安全出谋划策。然而,陈最终选择了一家建筑央企复出。

中国葛洲坝集团股份有限公司是一家由国务院国有资产监督管理委员会管理的特大型中央企业。葛洲坝国际公司是其下属子公司,2006年1月在北京成立,注册资本金达3.8亿元。

Jailed oil exec Chen Jiulin fills top SOE post

Just a year and a half after emerging from a Singapore prison, Chen Jiulin, ex-chief executive of China Aviation Oil (Singapore) Corp, has been appointed vice president of state-owned construction firm CGGC International Company Ltd.

Chen was sentenced to a prison term of four years and three months and fined US$207,500 for his pivotal role in the 2004 near-collapse of the Beijing-backed jet fuel trader, CAO (Singapore) Ltd. He was the first top state executive to be sent to prison abroad for insider trading.

Chen took over the helm of CAO (Singapore) Ltd. in 1997, and served as Managing Director, and CEO. The company, which suffered losses in the two years following its establishment in 1993, returned to profitability under Chen's leadership.

According to a 2004 report by PricewaterhouseCoopers, CAO (Singapore) Ltd suffered huge losses to the tune of US$550 million, due largely to speculation and unwise derivatives trading. Chen played a key role in the scandal.

Chen was released from prison on January 20, 2009. He published three articles about China's energy security, indicating his interest in returning to the oil industry. But his eventual comeback was as a top executive of a construction company.

CGGC International Company Ltd is a subsidiary of China Gezhouba Group Corporation, a large state-owned enterprise supervised by the State-owned Asset Supervision & Administration Commission of the State Council. It was established in Beijing in January 2006 with a registered capital of 380 million yuan (US$55.78 million).

English

English Japanese

Japanese Korean

Korean French

French German

German Spanish

Spanish Italian

Italian Arab

Arab Portuguese

Portuguese Vietnamese

Vietnamese Russian

Russian Finnish

Finnish Thai

Thai dk

dk